How to Identify Revenue Streams for Your Business

- in Finance

Every successful business relies on multiple streams of revenue to ensure its long-term sustainability and growth. Whether starting a new venture or looking to diversify income sources to beat the ongoing inflation 2023, identifying and developing revenue streams is crucial. Below is a list of ideas to help you identify and leverage revenue streams for your business.

Market Reach

Before you can identify revenue streams, you must deeply understand your target market. Research your audience’s needs, preferences, and pain points. Knowing your customers well allows you to effectively tailor your goods or services to match their demands.

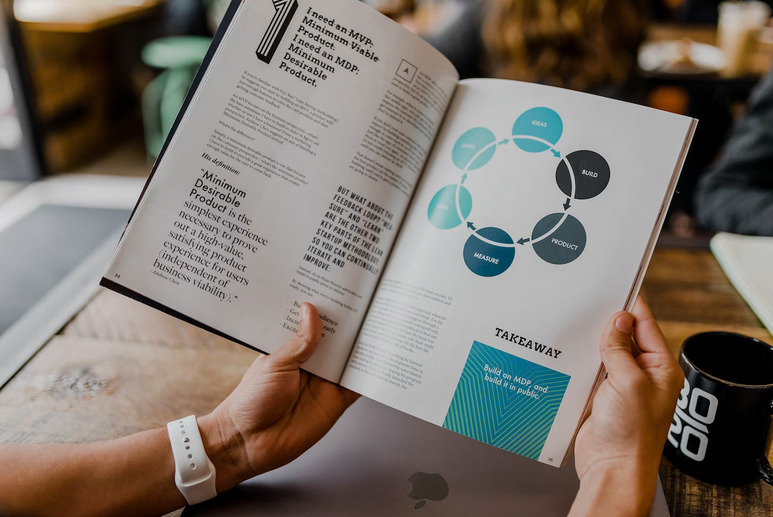

Core Product or Service

Start by evaluating your core product or service. This is typically the primary offering that defines your business. Identify opportunities to enhance or expand your core offering to attract customers or increase customer value. Consider adding or improving new features to make your product more attractive. If you offer a service, explore ways to diversify your service packages to cater to different customer segments.

Advertising and Sponsorships

Consider monetizing it through advertising and sponsorships if you have a significant online presence or platform. This can include display ads, sponsored content, or partnerships with relevant brands or companies.

Licensing and Intellectual Property

If your business has developed intellectual property, such as patents, trademarks, or copyrighted material, you can license these assets to others for a fee. Licensing agreements can provide a steady income stream.

Consulting and Training

Leverage your expertise by offering consulting services or training programs. Businesses and individuals often seek guidance and education to improve their skills or solve specific problems.

Affiliate Marketing

Consider participating in affiliate marketing programs where you promote goods or services from other enterprises and earn a commission for every sale generated through your referrals.

E-commerce and Merchandise

If you have a strong brand or a loyal customer base, selling branded merchandise or e-commerce products can be profitable. This can include clothing, accessories, or specialty products related to your business.

Joint Ventures and Partnerships

Explore opportunities to collaborate with other businesses or entrepreneurs in your industry. Joint ventures and partnerships can open doors to new revenue streams by combining resources, expertise, and customer bases.

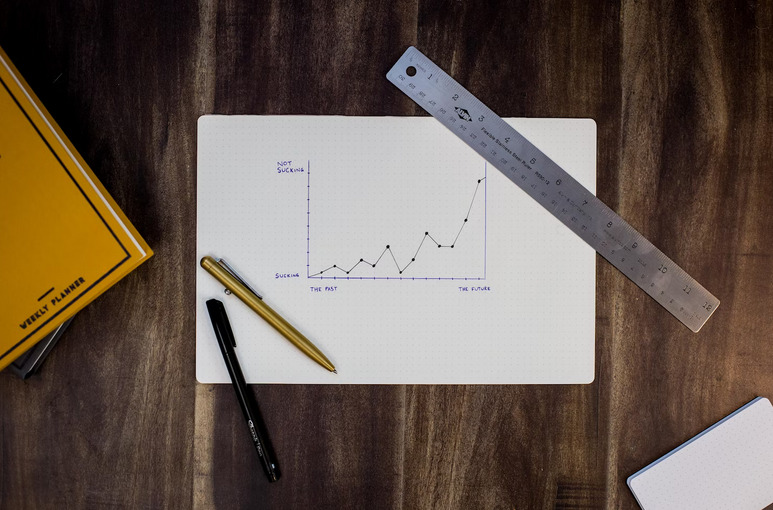

Identifying and diversifying revenue streams is essential for your business’s long-term success and resilience. Remember that not all revenue streams will be suitable for every business. It’s crucial to align your chosen revenue streams with your core competencies, customer base, and overall business strategy. By following the pointers shared, you can create a robust and sustainable revenue portfolio that fuels your business’s growth and stability.…

It’s easy to lose track of your money when you are busy running a business. For this reason, you must monitor how much cash flow you have.

It’s easy to lose track of your money when you are busy running a business. For this reason, you must monitor how much cash flow you have. Several factors can affect the success of your company. Once you identify these factors, you can take steps to prevent them from interfering with your company’s success. Below are three major factors that may lead to business bankruptcy:

Several factors can affect the success of your company. Once you identify these factors, you can take steps to prevent them from interfering with your company’s success. Below are three major factors that may lead to business bankruptcy:

Many programs tell you exactly how much cash flow you must have and the greatest weight is on what you are doing now and what you have done. When filling out a business income loan application, eligibility is determined solely by the average annual profit the business generates. If this is the case, the loan company is excellent for your business, regardless of the cost. The first thing is that you always want to decide to get the best price you qualify for.

Many programs tell you exactly how much cash flow you must have and the greatest weight is on what you are doing now and what you have done. When filling out a business income loan application, eligibility is determined solely by the average annual profit the business generates. If this is the case, the loan company is excellent for your business, regardless of the cost. The first thing is that you always want to decide to get the best price you qualify for. Some funding programs vary the character criteria in the target requirements to qualify for funding. These character requirements are the same as a return to particular funding programs or are considered other. All loans must make financial sense and meet the risk-reward requirements of the lending company. Any

Some funding programs vary the character criteria in the target requirements to qualify for funding. These character requirements are the same as a return to particular funding programs or are considered other. All loans must make financial sense and meet the risk-reward requirements of the lending company. Any

First of all, every banker will ask to see your bank statement, and it is going to be tough to get your loan approved if you don’t have them. It is the most crucial document before your loan is approved. The report will inform the banker about the money that has been deposited every month and in which way it’s been utilized. They’ll also see whether the amounts in the financial statements are in agreement with the ones on your bank statement.

First of all, every banker will ask to see your bank statement, and it is going to be tough to get your loan approved if you don’t have them. It is the most crucial document before your loan is approved. The report will inform the banker about the money that has been deposited every month and in which way it’s been utilized. They’ll also see whether the amounts in the financial statements are in agreement with the ones on your bank statement.  Another important document will be the financial statements of your organization. These reports will expose how the firm is doing every year. Some lenders may also ask you regarding the future financial plans of the company. So bear this in mind also.

Another important document will be the financial statements of your organization. These reports will expose how the firm is doing every year. Some lenders may also ask you regarding the future financial plans of the company. So bear this in mind also.

Accounting for your small company is also crucial so you can estimate your financial functionality. From the challenging economic times we’re facing now, having accurate accounting is essential. Many companies may help you in accounting for small businesses. Many small business owners think they will need to perform their accounting on their own.

Accounting for your small company is also crucial so you can estimate your financial functionality. From the challenging economic times we’re facing now, having accurate accounting is essential. Many companies may help you in accounting for small businesses. Many small business owners think they will need to perform their accounting on their own. When beginning your small business, one of the essential elements to consider is the bookkeeping procedure and how you decide to account for your financial advice. It’s necessary to see that your business’s financial data’s bookkeeping has to be precise, or your company might not be as powerful as planned. Even if you don’t like bookkeeping, there’s no way to prevent accounting for a business enterprise.

When beginning your small business, one of the essential elements to consider is the bookkeeping procedure and how you decide to account for your financial advice. It’s necessary to see that your business’s financial data’s bookkeeping has to be precise, or your company might not be as powerful as planned. Even if you don’t like bookkeeping, there’s no way to prevent accounting for a business enterprise.