How to Handle Customer Refunds and Credits in QuickBooks

- in Finance

Handling customer refunds and credits efficiently is essential for maintaining customer satisfaction and keeping your financial records accurate. QuickBooks, a leading accounting software, offers robust features to help you manage these transactions smoothly. But NetSuite to QuickBooks migration is not that simple. You have to ensure that customer refunds and credits are seamlessly transferred and integrated into your new system. In this article, we’ll explore how to handle customer refunds and credits in QuickBooks with eight practical steps.

Understand the Basics of Customer Refunds and Credits

Customer refunds and credits are crucial for managing customer accounts and ensuring financial accuracy. Customer refunds occur when a customer returns a product or requests a return of funds, while customer credits are applied to future purchases or used to resolve billing issues. Both are vital for maintaining good customer relationships and accurate records.

Set up Your Customer Accounts in QuickBooks

Before you process refunds or credits, ensure that your customer accounts are properly set up. Accurate customer records allow you to track transactions and manage accounts efficiently.

- Go to the **Customers** menu.

- Select **Customer Center**.

- Click **New Customer & Job** and enter the necessary details.

- Save and close.

Having detailed customer accounts ensures that refunds and credits are applied correctly.

Create a Credit Memo to Record Refunds

To handle a refund, you first need to create a credit memo in QuickBooks. This records the amount of the refund and the reason for it.

- Go to the **Customers** menu.

- Select **Create Credit Memos/Refunds**.

- Choose the customer and enter the refund details.

- Save and close.

Creating a credit memo is the first step in accurately processing a refund.

Process the Refund Using the Credit Memo

Once you’ve created a credit memo, you need to process the actual refund. QuickBooks allows you to issue a refund directly or apply it to a customer’s account balance.

- Go to the **Customers** menu.

- Select **Refunds & Credits**.

- Choose the credit memo you created.

- Select **Print Check** or **Create a Credit Card Refund**, depending on how the refund is issued.

- Complete the transaction and save.

Processing the refund ensures that your customer receives their money back, and your records remain accurate.

Manage Customer Credit Limits Effectively

Setting and managing customer credit limits helps control the amount of credit extended and prevents overextension. QuickBooks allows you to set and monitor these limits.

- Go to the **Customers** menu.

- Select **Customer Center**.

- Open the customer account and enter the credit limit in the **Credit Limit** field.

- Save and close.

Regularly review and adjust credit limits as needed to maintain control over your credit risk.

Record Partial Refunds and Credits Accurately

In cases where partial refunds or credits are necessary, QuickBooks makes it easy to handle them.

- Create a partial credit memo by going to the **Customers** menu and selecting **Create Credit Memos/Refunds**.

- Enter the partial refund amount and save.

- Apply the partial credit to the relevant invoice or issue the partial refund as needed.

Handling partial refunds and credits accurately ensures that your records reflect the correct amounts.

Generate Reports to Track Refunds and Credits

QuickBooks offers various reports to help you track and manage customer refunds and credits.

- Go to the **Reports** menu.

- Select **Customers & Receivables**.

- Choose reports such as **Customer Balance Detail** or **Refunds and Credits Report**.

These reports provide insights into customer transactions, helping you monitor and analyze refund and credit activities.

Managing customer refunds and credits efficiently is essential for maintaining accurate financial records and positive customer relationships. QuickBooks provides a range of tools to help you handle these transactions smoothly, from setting up customer accounts and creating credit memos to processing refunds and generating reports.…

The first step towards emergency credit repair is to review your credit report. There is this document which you can get from the bureaus that shows your financial history, including details about loans, credit cards, and payment patterns. By examining your credit report closely, you can see any errors or discrepancies that may be further negatively impacting your score.

The first step towards emergency credit repair is to review your credit report. There is this document which you can get from the bureaus that shows your financial history, including details about loans, credit cards, and payment patterns. By examining your credit report closely, you can see any errors or discrepancies that may be further negatively impacting your score.

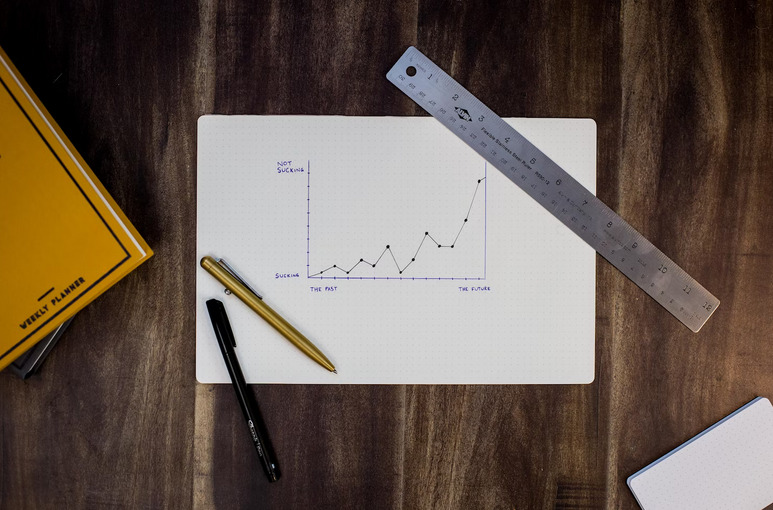

Imagine putting your money to work and watching it grow exponentially over time. That’s the beauty of compound interest. It’s like a snowball rolling down a hill, gaining momentum. Here’s how it works: when you invest your money, you earn returns on your initial investment.

Imagine putting your money to work and watching it grow exponentially over time. That’s the beauty of compound interest. It’s like a snowball rolling down a hill, gaining momentum. Here’s how it works: when you invest your money, you earn returns on your initial investment.

Keeping a finger on the pulse of every market trend is a crucial aspect of successful silver investing. By analyzing and understanding these trends along with the

Keeping a finger on the pulse of every market trend is a crucial aspect of successful silver investing. By analyzing and understanding these trends along with the  When used strategically with proper risk management techniques, investing in silver futures can offer opportunities for profit-taking based on anticipated price movements. However, like any investment approach, thorough research and understanding are essential before diving into this strategy.

When used strategically with proper risk management techniques, investing in silver futures can offer opportunities for profit-taking based on anticipated price movements. However, like any investment approach, thorough research and understanding are essential before diving into this strategy.

xperts agree that a proper plan for retirement medical expenses will come out great if you leverage a Health Savings Account (HSA). This account plays a huge role as a savings account based on the tax advantages that can do much more than you can imagine. It can pay your approved medical expenses.

xperts agree that a proper plan for retirement medical expenses will come out great if you leverage a Health Savings Account (HSA). This account plays a huge role as a savings account based on the tax advantages that can do much more than you can imagine. It can pay your approved medical expenses. No financial plan is a success without proper, deep understanding. So don’t stop yourself from asking questions about health insurance policies. Ask what services are covered, what percentage of the cost is covered by insurance, and if there are any restrictions on doctors or hospitals you can visit.

No financial plan is a success without proper, deep understanding. So don’t stop yourself from asking questions about health insurance policies. Ask what services are covered, what percentage of the cost is covered by insurance, and if there are any restrictions on doctors or hospitals you can visit.

A gold IRA offers an excellent way to invest in

A gold IRA offers an excellent way to invest in  ETFs are funds that trade on stock exchanges and track the performance of an index or basket of assets. ETFs are a great way to invest in multiple stocks and securities without having to pay any taxes on your gains. You can invest in ETFs that track popular indices like the S&P 500, or you can be more specific and invest in an ETF focused on a particular sector or industry.

ETFs are funds that trade on stock exchanges and track the performance of an index or basket of assets. ETFs are a great way to invest in multiple stocks and securities without having to pay any taxes on your gains. You can invest in ETFs that track popular indices like the S&P 500, or you can be more specific and invest in an ETF focused on a particular sector or industry.

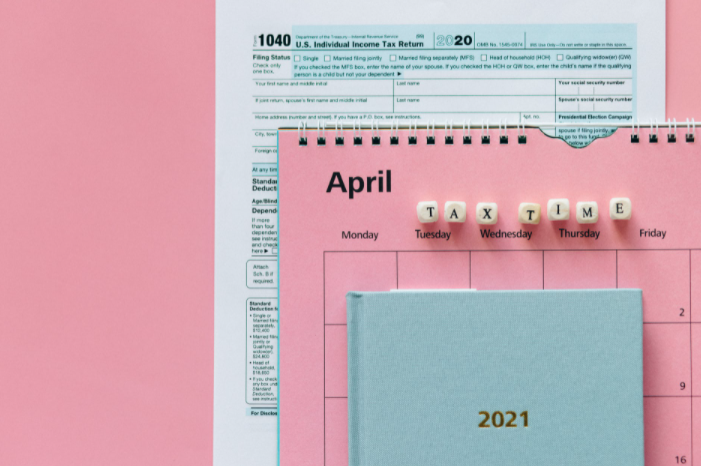

Tax breaks are one of the most important financial factors when purchasing a home. Homeowners can deduct mortgage interest and property taxes from their annual income tax returns in many areas. This can significantly reduce the amount of money you’re paying in taxes yearly, making it a precious factor worth considering before signing on the dotted line.

Tax breaks are one of the most important financial factors when purchasing a home. Homeowners can deduct mortgage interest and property taxes from their annual income tax returns in many areas. This can significantly reduce the amount of money you’re paying in taxes yearly, making it a precious factor worth considering before signing on the dotted line. In addition to the cost of the loan itself, several ancillary costs come with purchasing a home. These include closing costs, inspection fees, title insurance, and more. It’s important to consider all these before signing on the dotted line, so you don’t have any surprises later down the road.

In addition to the cost of the loan itself, several ancillary costs come with purchasing a home. These include closing costs, inspection fees, title insurance, and more. It’s important to consider all these before signing on the dotted line, so you don’t have any surprises later down the road.

When taking out a short-term loan, the most important thing to remember is that you should only take out what you can afford and use the money for its intended purpose. Short-term loans are helpful for covering unexpected expenses or bridging cash flow gaps between pay periods, but they should not be used to fund a large purchase. It is important to consider all the costs associated with taking out the loan, such as any fees and interest payments, to determine if it is affordable for you in the long run.

When taking out a short-term loan, the most important thing to remember is that you should only take out what you can afford and use the money for its intended purpose. Short-term loans are helpful for covering unexpected expenses or bridging cash flow gaps between pay periods, but they should not be used to fund a large purchase. It is important to consider all the costs associated with taking out the loan, such as any fees and interest payments, to determine if it is affordable for you in the long run. Before applying for any kind of loan, it is important to check your credit score first. This will give you an idea of what type of interest rate and repayment terms you can expect from the lender. A good credit score will help you secure the best loan deal, so maintain a good credit standing before applying for any loan.

Before applying for any kind of loan, it is important to check your credit score first. This will give you an idea of what type of interest rate and repayment terms you can expect from the lender. A good credit score will help you secure the best loan deal, so maintain a good credit standing before applying for any loan.

A crypto trading bot is a software program that automates buying and selling cryptocurrencies. These bots can be used to trade on various exchanges and can be customized to fit your specific trading needs. For example, you can set up a bot to trade only during certain hours of the day or specify which currencies you want it to trade. Many different types of crypto trading bots are available, and they all have advantages and disadvantages. Some bots are free to use, while others require a monthly subscription. And some bots are only available for certain exchanges.

A crypto trading bot is a software program that automates buying and selling cryptocurrencies. These bots can be used to trade on various exchanges and can be customized to fit your specific trading needs. For example, you can set up a bot to trade only during certain hours of the day or specify which currencies you want it to trade. Many different types of crypto trading bots are available, and they all have advantages and disadvantages. Some bots are free to use, while others require a monthly subscription. And some bots are only available for certain exchanges.

Bad credit can also lead to higher insurance rates. Many insurance companies now use credit scores to help determine premiums. If your score is low, you may pay more for your auto or homeowners’ insurance. If you have bad credit, it’s crucial to improve your score. You can do various things to improve your credit, including paying your bills on time, maintaining an excellent credit history, and using less of your available credit. These steps can help you improve your credit score and get back on track financially.…

Bad credit can also lead to higher insurance rates. Many insurance companies now use credit scores to help determine premiums. If your score is low, you may pay more for your auto or homeowners’ insurance. If you have bad credit, it’s crucial to improve your score. You can do various things to improve your credit, including paying your bills on time, maintaining an excellent credit history, and using less of your available credit. These steps can help you improve your credit score and get back on track financially.…

The most important thing you can do when applying for a car loan is to maintain good credit. This means making all of your payments on time and keeping your debt levels low. If you have good credit, lenders will be more likely to approve your loan and offer you lower interest rates. Maintaining good credit is essential to getting your car loan approved. Lenders will first look at this when considering your loan application, so it’s important to make sure your credit is in good shape before you apply.

The most important thing you can do when applying for a car loan is to maintain good credit. This means making all of your payments on time and keeping your debt levels low. If you have good credit, lenders will be more likely to approve your loan and offer you lower interest rates. Maintaining good credit is essential to getting your car loan approved. Lenders will first look at this when considering your loan application, so it’s important to make sure your credit is in good shape before you apply.

Your home equity is the portion of your home that you own outright or have paid off. Many homeowners don’t realize that they have built up equity in their homes until they try to refinance their mortgage. To determine how much equity you have in your home, you can talk to your lender or a housing counselor. Moreover, it would help if you got your home appraised. A professional appraisal will give you a good idea of how much your home is worth on the current market. This information will be helpful when you start shopping for new mortgage rates.

Your home equity is the portion of your home that you own outright or have paid off. Many homeowners don’t realize that they have built up equity in their homes until they try to refinance their mortgage. To determine how much equity you have in your home, you can talk to your lender or a housing counselor. Moreover, it would help if you got your home appraised. A professional appraisal will give you a good idea of how much your home is worth on the current market. This information will be helpful when you start shopping for new mortgage rates.

Investing all of your money in gold is risky. If the price of

Investing all of your money in gold is risky. If the price of  If your gold is lost or stolen, it will be gone forever unless you have insurance. Insure your gold so that you can get compensated if it’s lost or stolen. It’s important to insure your gold so that you can get paid if it’s ever lost or stolen. Without insurance, you could lose your entire

If your gold is lost or stolen, it will be gone forever unless you have insurance. Insure your gold so that you can get compensated if it’s lost or stolen. It’s important to insure your gold so that you can get paid if it’s ever lost or stolen. Without insurance, you could lose your entire

When you are looking for a

When you are looking for a  When looking for the best gold IRA companies, it is essential to verify the fees associated with each company. Some companies will charge hidden costs, which can eat into your investment. Others may have higher costs than others. Be sure to find out the fees before making your final decision. The best gold IRA companies will have transparent prices and be upfront about their process. They should also have an excellent online presence to find information about them quickly. Be sure to check out the Better Business Bureau’s website before making your final decision. The BBB is an excellent resource for finding out more about other gold IRA companies.…

When looking for the best gold IRA companies, it is essential to verify the fees associated with each company. Some companies will charge hidden costs, which can eat into your investment. Others may have higher costs than others. Be sure to find out the fees before making your final decision. The best gold IRA companies will have transparent prices and be upfront about their process. They should also have an excellent online presence to find information about them quickly. Be sure to check out the Better Business Bureau’s website before making your final decision. The BBB is an excellent resource for finding out more about other gold IRA companies.…

One of the top benefits of crypto trading is the increased liquidity of cryptocurrencies. It is easier than ever to buy and sell cryptocurrencies with exchanges becoming more popular. This allows for a more active market and helps to stabilize prices. Cryptocurrencies are also becoming more accepted as payment methods. This means that you can use them to buy goods and services online or in person. As the popularity of cryptocurrencies continues to grow, so will their liquidity.

One of the top benefits of crypto trading is the increased liquidity of cryptocurrencies. It is easier than ever to buy and sell cryptocurrencies with exchanges becoming more popular. This allows for a more active market and helps to stabilize prices. Cryptocurrencies are also becoming more accepted as payment methods. This means that you can use them to buy goods and services online or in person. As the popularity of cryptocurrencies continues to grow, so will their liquidity. Compared to other types of trading, crypto trading has lesser risk exposure. There are a few things that you can do to make sure of this, which include doing your research, evaluating the market, and being wise and careful with your investment, If you’re looking for a new and exciting way to make money, crypto trading may be just what you need. The opportunities are endless, and you can trade on global markets with ease. Just take a look at what other people have achieved so far in the world of cryptocurrency. It’s pretty amazing! So, what are you waiting for?…

Compared to other types of trading, crypto trading has lesser risk exposure. There are a few things that you can do to make sure of this, which include doing your research, evaluating the market, and being wise and careful with your investment, If you’re looking for a new and exciting way to make money, crypto trading may be just what you need. The opportunities are endless, and you can trade on global markets with ease. Just take a look at what other people have achieved so far in the world of cryptocurrency. It’s pretty amazing! So, what are you waiting for?…

When you want to short Bitcoin, the first step is to sell your Bitcoin to an individual. You can find someone who wants to buy your Bitcoin on various online exchanges or through online forums. Once you have sold your Bitcoin, you will need to deposit the money into a regulated forex broker account.

When you want to short Bitcoin, the first step is to sell your Bitcoin to an individual. You can find someone who wants to buy your Bitcoin on various online exchanges or through online forums. Once you have sold your Bitcoin, you will need to deposit the money into a regulated forex broker account. If you don’t want to go through the hassle of finding someone who wants to buy your Bitcoin futures contract, or if you’re going to get started quickly, then using an exchange is a great option. You can use exchanges like Bitfinex, Poloniex, and Kraken to short Bitcoin. These exchanges allow you to borrow Bitcoins from other traders on the exchange to sell them.

If you don’t want to go through the hassle of finding someone who wants to buy your Bitcoin futures contract, or if you’re going to get started quickly, then using an exchange is a great option. You can use exchanges like Bitfinex, Poloniex, and Kraken to short Bitcoin. These exchanges allow you to borrow Bitcoins from other traders on the exchange to sell them.

The next step is to make sure you keep all of your receipts in one place. You can do this by asking for digital copies when making a purchase or taking photos with your phone and uploading the image right away (that way, there’s no risk of losing it). If you cannot get a copy, at least try to get the receipt emailed to you. It would help if you also kept any receipts from a digital purchase, such as those for meals or other miscellaneous items. These can be stored in an envelope with each month’s name on it and kept at home until tax time comes around (it doesn’t hurt to check them off once in a while to make sure everything is still there).

The next step is to make sure you keep all of your receipts in one place. You can do this by asking for digital copies when making a purchase or taking photos with your phone and uploading the image right away (that way, there’s no risk of losing it). If you cannot get a copy, at least try to get the receipt emailed to you. It would help if you also kept any receipts from a digital purchase, such as those for meals or other miscellaneous items. These can be stored in an envelope with each month’s name on it and kept at home until tax time comes around (it doesn’t hurt to check them off once in a while to make sure everything is still there).

It’s easy to lose track of your money when you are busy running a business. For this reason, you must monitor how much cash flow you have.

It’s easy to lose track of your money when you are busy running a business. For this reason, you must monitor how much cash flow you have. Several factors can affect the success of your company. Once you identify these factors, you can take steps to prevent them from interfering with your company’s success. Below are three major factors that may lead to business bankruptcy:

Several factors can affect the success of your company. Once you identify these factors, you can take steps to prevent them from interfering with your company’s success. Below are three major factors that may lead to business bankruptcy:

Gold bars are a great way to invest in gold because they are the purest form of investment-grade gold and come with less markup. When you buy bars, make sure it’s an assayed bar which means that there is also an International Assay Office (IAO) hallmark on each one – this ensures its authenticity! By having gold bars, you guarantee yourself a higher value of gold than gold coins.

Gold bars are a great way to invest in gold because they are the purest form of investment-grade gold and come with less markup. When you buy bars, make sure it’s an assayed bar which means that there is also an International Assay Office (IAO) hallmark on each one – this ensures its authenticity! By having gold bars, you guarantee yourself a higher value of gold than gold coins. Gold stock is relatively stable even in a tumultuous time like today. The price of gold is not tied to the stock market, so it doesn’t usually rise or fall based on how well other investments are doing. If you’re thinking about investing in gold stocks, then make sure that you choose a company with an excellent track record and solid management team! If they were to go bankrupt for some reason, what would you do with your portfolio? Most likely, you would lose money. This is why it’s best to go with a company investing in gold for years and has weathered good times and bad.

Gold stock is relatively stable even in a tumultuous time like today. The price of gold is not tied to the stock market, so it doesn’t usually rise or fall based on how well other investments are doing. If you’re thinking about investing in gold stocks, then make sure that you choose a company with an excellent track record and solid management team! If they were to go bankrupt for some reason, what would you do with your portfolio? Most likely, you would lose money. This is why it’s best to go with a company investing in gold for years and has weathered good times and bad.

Many reputable companies offer health insurance to their employees. HMOs and PPOs are terms used to describe employer-sponsored insurance benefits. Health Maintenance Organization (HMO) is the most popular type of insurance. This type of insurance only pays for medical visits within the plan’s network. If you choose a PPO (Preferred Provider Organization), the insurance company will only pay a portion of the cost of your care.

Many reputable companies offer health insurance to their employees. HMOs and PPOs are terms used to describe employer-sponsored insurance benefits. Health Maintenance Organization (HMO) is the most popular type of insurance. This type of insurance only pays for medical visits within the plan’s network. If you choose a PPO (Preferred Provider Organization), the insurance company will only pay a portion of the cost of your care.

Many programs tell you exactly how much cash flow you must have and the greatest weight is on what you are doing now and what you have done. When filling out a business income loan application, eligibility is determined solely by the average annual profit the business generates. If this is the case, the loan company is excellent for your business, regardless of the cost. The first thing is that you always want to decide to get the best price you qualify for.

Many programs tell you exactly how much cash flow you must have and the greatest weight is on what you are doing now and what you have done. When filling out a business income loan application, eligibility is determined solely by the average annual profit the business generates. If this is the case, the loan company is excellent for your business, regardless of the cost. The first thing is that you always want to decide to get the best price you qualify for. Some funding programs vary the character criteria in the target requirements to qualify for funding. These character requirements are the same as a return to particular funding programs or are considered other. All loans must make financial sense and meet the risk-reward requirements of the lending company. Any

Some funding programs vary the character criteria in the target requirements to qualify for funding. These character requirements are the same as a return to particular funding programs or are considered other. All loans must make financial sense and meet the risk-reward requirements of the lending company. Any

After you say go on the World Wide Web, we suggest developing a search on the major loan issuers. The moment you have a wonderful selection of two or three banks, another action would be to research each loan.

After you say go on the World Wide Web, we suggest developing a search on the major loan issuers. The moment you have a wonderful selection of two or three banks, another action would be to research each loan. Approvals take some time, but usually, you should do up to twenty-four hours of loan permission. After researching different money lenders, pay attention to the total interest rate that each lender provides. Remember that the interest

Approvals take some time, but usually, you should do up to twenty-four hours of loan permission. After researching different money lenders, pay attention to the total interest rate that each lender provides. Remember that the interest